- Home

- Departments

- Finance

- Financial Snapshot

Financial Snapshot

The City of Buffalo developed the financial snapshot to give residents, business owners and stakeholders a glimpse into the City’s finances and our financial performance. The page includes our most recent, audited, information on city property taxes, debt, debt limit, and bond rating.

If you are interested in looking deeper at the City’s finances, we encourage you to look at our budget documents, capital improvement plan, and audited financial statements.

As always, we are available to answer any questions you have.

Thank you!

(click on graphics/images for larger view)

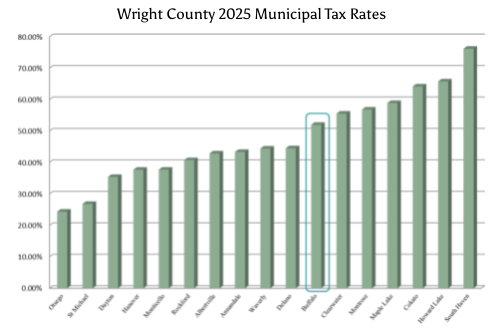

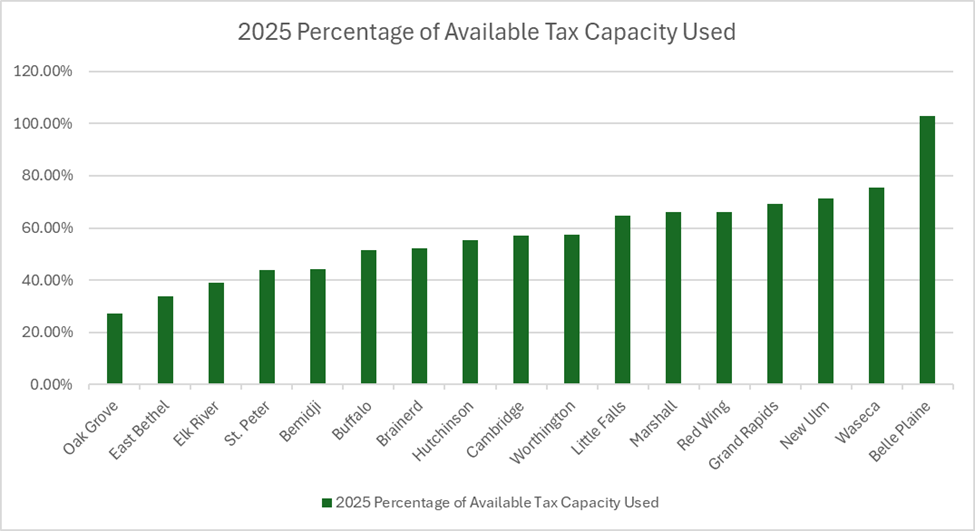

Section 1 - Property Taxes and Tax Rates

2025 City of Buffalo Levy Breakdown

General Fund Revenue $7,587,192

Debt Service $2,782,917

Pavement Management $1,000,000

Lease Purchase $462,777

Civic Center $250,000

Parks Improvement $100,000

Library $95,000

EDA $20,300

Total $12,298,186

2025 City of Buffalo Tax Levy Use

General Fund Revenue 60%

Debt Service 25%

Pavement Improvement 8%

HRA 3%

Civic Center 2%

Library 1%

Parks Improvement 1%

Section 2 - Debt, Debt by Type, and Amortization

Section 2 - Debt, Debt by Type, and Amortization

Total debt as of 12/31/2024: $78,570,343.13

- Total Debt supported by Property Taxes - $27,505,543

- Total Debt supported by Enterprise Activities - $51,064,800

Note: To assist in making the large payments on the 2014A GO Sewer and Water Revenue Refunding Bond (Enterprise Activity Category), the city has been levying $500,000 per year for the past several years.

Note: The city has entered into a bond sale in 2025 for $6.39 million in temporary tax abatement bonds for Phase 2 of Buffalo Fiber Expansion.

Section 3 - Debt Limit

The limit on municipal debt is defined in MN Statute 475.53. The limit is 3% of the estimated market value of taxable property in the municipality. Revenue bonds and tax abatement bonds do not apply to the debt limit because they have other primary financing sources outside of the levy.

Section 4 - Debt Limit History

Section 5 - Bond Rating

Buffalo was recently assigned a ‘AA’ bond rating from S&P, which is 3rd highest rating (out of 20) a city can receive.

Summary from the most recent report – “Buffalo's stable operations, which have led to healthy reserves; growing tax base; and above-average management practices support the 'AA' long-term rating.”

Full bond rating can be found by clicking here.

If you have questions regarding the information provided on this page, please don't hesitate to reach out to City Administrator, Taylor Gronau or Finance Director/Assistant City Administrator, Joshua Kent.

-

Taylor Gronau

City Administrator

-

Joshua Kent

Finance Director/Assistant City Administrator